The Risk Of Relying Solely On Claims Data In Pharma

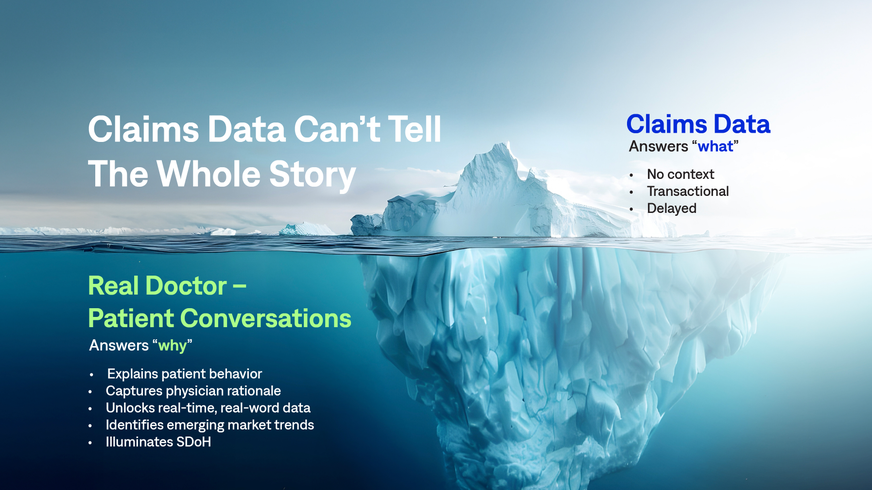

Pharma and biotech companies spend a small fortune on data every year. From claims and electronic health records (EHRs) to prescription data and market research intel, data fuels everything—drug development, market access strategies, marketing strategies, and patient support programs. But here’s the catch: if you’re relying on claims data alone, you’re much more likely to misread critical market shifts.

Claims and other structured datasets can’t explain why patients stop taking a drug, or how socioeconomic factors impact treatment outcomes. And, if your claims data is ever wrong, you won’t have contextual clues to tell you that a market shift is emerging or has occurred. Without the rich insights that are buried in free-text notes and patient narratives, you lose the ability to question other data, and you likely undervalue human factors.

According to Michele Graham, President of Intel & Learn at Amplity, “When the data you’re using to make decisions contains errors or gaps, the consequences can be costly—not just in dollars, but in lost opportunities.”

Claims Data: What It Does (And Doesn’t) Tell You

While claims data is the primary source for tracking prescriptions and reimbursement trends, claims data falls short in many key areas:

- It’s Limited To A Retrospective Or Historic Story

Adjudicated claims data has a built-in lag, often months long. By the time you spot a trend, it’s too late to act. This limitation creates challenges in responding to emerging market dynamics or competitive threats in a timely manner.

- It Lacks Real-World Context

Claims can tell you how many patients filled their prescriptions, but they don’t explain why some never start treatment, why others stop midway, or how social factors like income or transportation play a role. “There’s always a blind spot when it comes to understanding the real barriers patients face—transportation, affordability, or even education about their condition. Claims data just doesn’t capture these nuances,” noted Lonny Schilt, Head of Sales Operations & Enablement at Amplity.

- It’s Transactional, Not Behavioral

Claims focus on reimbursable events—procedures, prescriptions, diagnoses—but don’t capture the human side of treatment, like patient preferences or physician hesitations.

For pharma leaders, this means claims data alone can’t answer critical questions:

- Why are patients abandoning therapy?

- What barriers are physicians facing in prescribing your drug?

- What do physicians tell patients about your competitors’ products?

- What unmet needs exist in the market that your pipeline could address?

This is where unstructured data comes in.

Why Unstructured Data Is Pharma’s Secret Weapon

Unstructured data, which includes physician notes, patient surveys, transcripts from doctor-patient conversations, and call center transcripts, fills gaps that claims data and other traditional datasets simply cannot provide.

For example, unstructured data has helped manufacturers improve efficiency and reduce costs by finding patients faster and refining marketing strategies. “We’ve seen firsthand how unstructured data can unlock insights that directly translate into better targeting and faster patient identification—it’s transformative,” said Graham.

Here’s why unstructured data, particularly doctor-patient conversations, is a game-changer for pharma:

- It Explains Patient Behavior

Unstructured data helps biopharma executives understand the “why” behind adherence, persistence, and abandonment. For instance, physician-patient transcripts can clearly reveal when patients discontinue treatments due to side effects or cost concerns. These insights can then be translated into strategies and tactics that refine patient support programs, or reframe unmet clinical needs in ways that positively shape drug development.

- It Captures The Voice Of The Physician

Claims data tells you what was prescribed, but physician-patient conversations tell you why by revealing prescribing hesitations, off-label usage trends, or issues with accepting certain kinds of data that could inform your market strategy. “Real-time physician conversations are gold mines of information. They reveal disease perceptions, treatment concerns, and competitor insights that structured data overlooks and claims data misses entirely,” commented Graham.

- It Unlocks RWD Right Away

Regulatory bodies and payers are increasingly demanding P4 and real-world data (RWD) studies to demonstrate the ongoing value of most therapies. Patient-reported outcomes or social determinants of health (SDoH) provides the context needed to strengthen your in-market research and publication planning strategies.

- It Identifies Emerging Market Trends

AI and natural language processing (NLP)-driven tools can sift through unstructured data to spot trends early—like increasing mentions of a specific side effect in clinical notes. “The ability to identify market altering trends early—whether it’s patient sentiment or physician feedback—gives manufacturers a competitive edge,” Schilt explained.

- It Illuminates Social Determinants Of Health

SDoH—such as housing, income, and access to care—are critical drivers of patient outcomes but rarely captured in structured datasets. Unstructured data sources can fill this gap, enabling you to design more effective interventions and improve health equity.

The Risks Of Ignoring Unstructured Data

Failing to integrate unstructured data like physician-patient conversations into your analytics strategy can have negative impacts to a product’s bottom line.

-

- Missed Opportunities: Without unstructured insights, you could overlook early signals of patient dissatisfaction, emerging competitive threats, or unmet needs in your therapeutic area.

- Poor Adherence & Outcomes: Incomplete data limits your ability to design effective patient interventions, leading to lower adherence and worse outcomes.

- Weaker Market Access Strategies: Payers demand robust evidence to justify pricing and reimbursement. Without the context provided by unstructured data, your product may not lack the evidence needed to secure coverage or a favorable formulary positioning.

- Inefficient Resource Allocation: When you’re working with incomplete or inaccurate information—such as flawed predictive analytics—you risk investing in strategies that don’t address the root causes of market challenges.

The good news? We can help.

How AnswerY Adds The Human Factor With Doctor-Patient Conversations

AI platform Amplity AnswerY™ takes unstructured data—HIPAA-compliant patient-provider conversations—and uses advanced NLP to turn 80K+ records into millions of actionable insights.

This platform doesn’t just confirm what you already know from claims—it goes deeper. It connects the dots, giving you a richer, more complete picture of what’s really happening between physicians and patients. It provides the human factor. As Michele Graham puts it, “Unstructured data helps us understand the ‘why’ behind the numbers. It captures nuances that claims data can never reveal.”

And here’s the best part: Every doctor-patient conversation is packed with insights, and with transcriptions refreshed every 30 days and 1 million new records added monthly, AnswerY’s insights are always current and relevant.

Whether it’s analyzing physician notes, mining patient-reported outcomes, or spotting emerging trends, AnswerY helps pharma teams across the board:

-

- Sales teams can identify hard to reach populations (like patients with rare diseases), target the right HCPs, and customize their pre-call planning and follow-up activities to drive more scripts.

- Marketing leaders can take primary market research to new levels—at a fraction of the time and cost—enabling precise segmentation and messaging using real-time behavioral information.

- Medical teams can identify patients to advance clinical trial enrollment and tailor their KOL engagements to achieve desired educational goals.

- Real-world data leaders can create more robust and less costly P4 and health economics outcomes studies using HIPAA-compliant prescriber sentiment.

Graham summed it up best: “Unstructured data, like doctor-patient conversations, isn’t just the missing piece—it’s the competitive edge. It helps you make smarter decisions faster, whether we’re helping our biopharma partners refine their pre-launch strategy or address prescribing barriers.”

The Future Of Pharma Analytics

In today’s competitive landscape, unstructured data has evolved from a “nice-to-have” to a critical asset that’s being used by market leaders. AI tools like AnswerY are transforming the way unstructured data is accessed and used, delivering actionable insights that drive better patient outcomes, smarter strategies, and stronger commercial and medical performance.

Want to learn more? Find out how AnswerY can help you turn untapped insights into real-world results.